Just How VA Home Loans Make Homeownership Affordable for Veterans

The Essential Guide to Home Loans: Opening the Advantages of Flexible Funding Options for Your Desire Home

Browsing the intricacies of home car loans can commonly really feel daunting, yet understanding flexible financing choices is necessary for possible home owners. VA Home Loans. With a variety of car loan kinds readily available, consisting of government-backed options and adjustable-rate mortgages, borrowers can tailor their financing to align with their private monetary situations.

Understanding Home Loans

Recognizing home mortgage is essential for possible home owners, as they stand for a considerable economic dedication that can affect one's economic health and wellness for many years to find. A home mortgage, or home mortgage, is a kind of debt that allows individuals to obtain money to purchase a property, with the residential property itself functioning as security. The lending institution gives the funds, and the debtor agrees to repay the loan quantity, plus interest, over a given period.

Secret components of home loans consist of the principal quantity, interest rate, loan term, and regular monthly payments. The principal is the original financing quantity, while the interest rate identifies the price of borrowing. Financing terms usually vary from 15 to 30 years, influencing both month-to-month repayments and total interest paid.

Kinds Of Flexible Funding

Versatile funding choices play an important duty in fitting the varied needs of property buyers, allowing them to customize their home mortgage remedies to fit their monetary situations. Among the most widespread sorts of adaptable financing is the variable-rate mortgage (ARM), which offers a first fixed-rate period adhered to by variable prices that vary based on market conditions. This can offer reduced initial settlements, appealing to those that expect earnings development or plan to transfer before rates readjust.

Another alternative is the interest-only mortgage, enabling borrowers to pay only the passion for a specified period. This can cause lower month-to-month payments at first, making homeownership extra obtainable, although it may result in bigger repayments later on.

Furthermore, there are likewise hybrid finances, which incorporate features of taken care of and variable-rate mortgages, offering security for an established term adhered to by adjustments.

Finally, government-backed loans, such as FHA and VA finances, supply flexible terms and lower down repayment needs, satisfying novice purchasers and experts. Each of these options provides special advantages, allowing homebuyers to choose a financing option that straightens with their long-term individual circumstances and economic goals.

Advantages of Adjustable-Rate Mortgages

How can variable-rate mortgages (ARMs) profit homebuyers looking for affordable funding options? ARMs use visit their website the potential for reduced initial rate of interest compared to fixed-rate home loans, making them an eye-catching choice for customers looking to decrease their regular monthly repayments in the very early years of homeownership. This first duration of lower rates can substantially boost price, allowing homebuyers to invest the cost savings in various other top priorities, such as home improvements or savings.

Furthermore, ARMs commonly feature a cap framework that limits just how much the rate of interest can raise throughout change durations, giving a degree of predictability and defense versus severe changes in the marketplace. This attribute can be specifically advantageous in a rising interest rate environment.

Additionally, ARMs are suitable for customers that intend to re-finance or market prior to the loan adjusts, enabling them to capitalize on the lower rates without exposure to prospective price boosts. Because of this, ARMs can work as a critical financial device for those that fit with a degree of threat and are wanting to optimize their buying power in the present real estate market. On the whole, ARMs can be an engaging alternative for savvy property buyers seeking adaptable financing options.

Government-Backed Loan Choices

FHA fundings, guaranteed by the Federal Housing Administration, are suitable for first-time property buyers and those with reduced credit history. They generally need a reduced down payment, making them a popular option for those that might battle to conserve a substantial amount for a conventional funding.

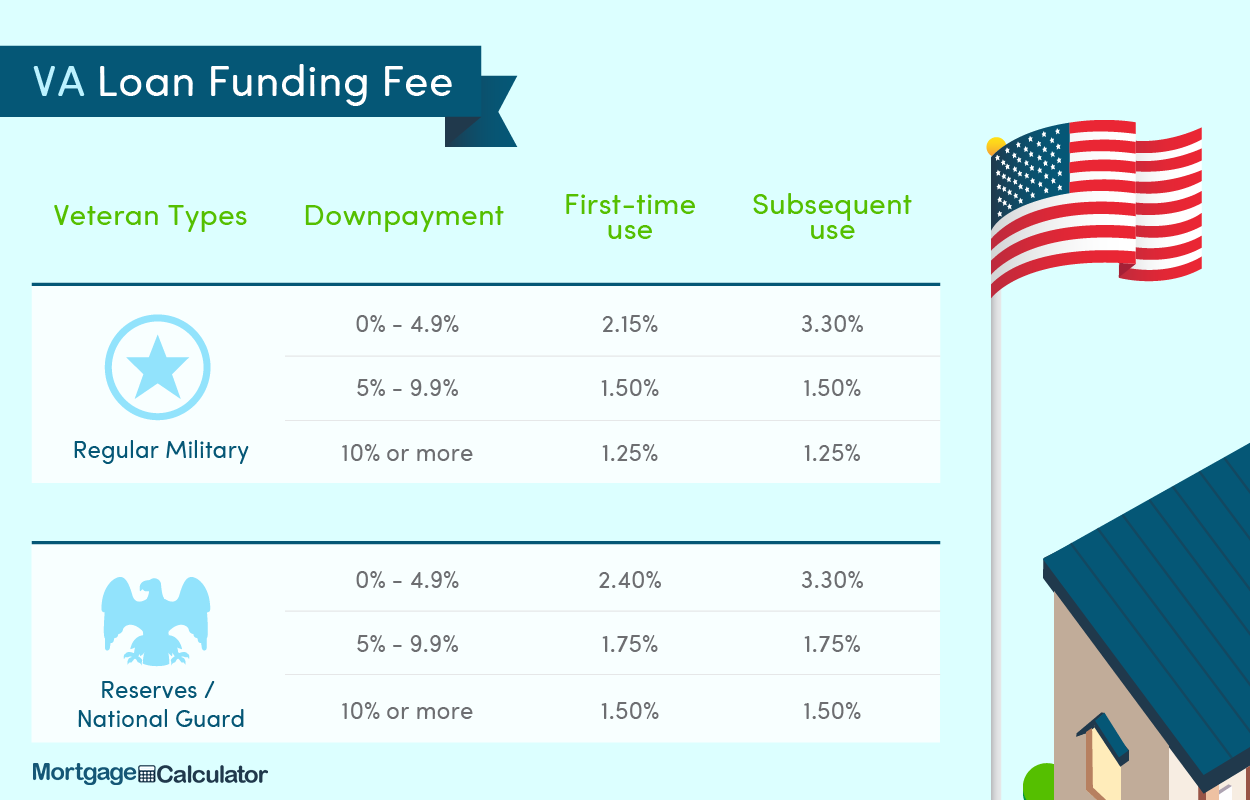

VA loans, readily available to experts and active-duty army employees, supply positive terms, including no exclusive home mortgage and no down payment insurance coverage (PMI) This makes them an attractive option for eligible consumers seeking to purchase a home without the problem of added expenses.

Tips for Picking the Right Car Loan

When reviewing funding options, debtors frequently take advantage of thoroughly examining their economic situation and long-lasting objectives. Start by identifying your spending plan, which includes not just the home acquisition price however additionally extra prices such as home tax obligations, insurance, and upkeep (VA Home Loans). This comprehensive understanding will assist you in picking a lending that fits your monetary landscape

Following, take into consideration the kinds of lendings offered. Fixed-rate home loans supply security in monthly payments, while adjustable-rate home loans might give reduced first their website rates but can fluctuate gradually. Analyze your risk tolerance and the length of time you prepare to remain in the home, as these variables will influence your funding selection.

In addition, scrutinize rates of interest and fees connected with each finance. A reduced rate of interest can substantially minimize the complete expense with time, however bear in mind closing prices and various other costs that could counter these savings.

Verdict

In verdict, navigating the landscape of home loans exposes countless versatile funding options that provide to varied customer demands. Understanding the ins and outs of numerous funding kinds, including government-backed financings and adjustable-rate mortgages, allows educated decision-making.

Navigating the complexities of home loans can typically really feel complicated, yet recognizing flexible financing choices is essential for potential house owners. A home financing, or mortgage, is a type of financial obligation that enables people to obtain cash to acquire a residential property, with the residential or commercial property itself serving as collateral.Secret elements of home financings consist of the major quantity, passion price, loan term, and monthly payments.In conclusion, navigating the landscape of home car loans exposes many adaptable funding choices that provide to varied debtor requirements. Comprehending the ins and outs of different finance kinds, consisting of adjustable-rate home mortgages and government-backed financings, makes it possible for informed decision-making.